It has been a wild week for the markets. A global selloff in bonds sparked fears that we are heading into the final innings of the bull market. Major equity markets fell into correction territory and struggled to find support as the week went on, but what has really changed? We review what sparked this turnaround, why it may be an overreaction, and why our long-term outlook for global equities remains positive.

Are Markets hitting the reset button or will the global selloff continue?

What Happened?

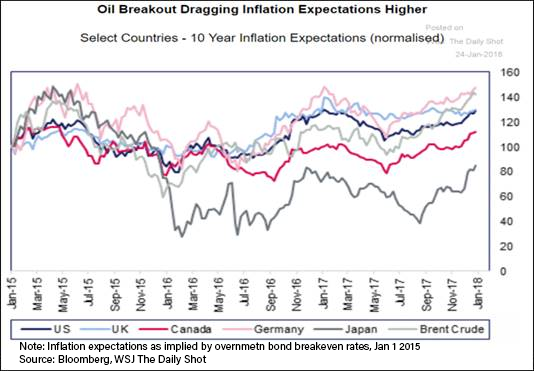

Heading into the final week of January rising global inflation expectations led to a global selloff in the bond market which caused interest rates to rise.

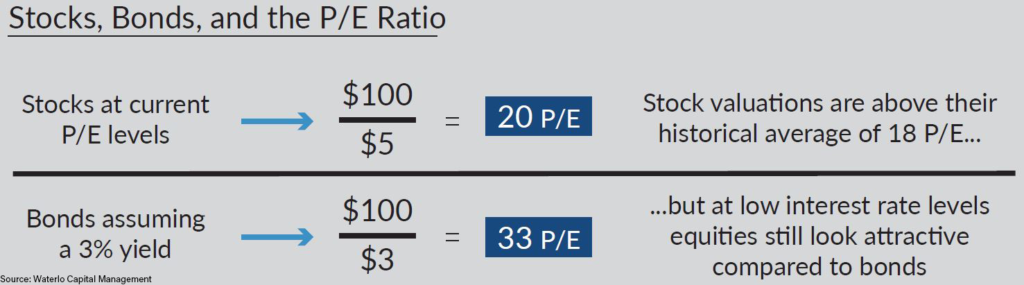

Because of the inverse relationship between bond prices and interest rates interest rates rise as investors sell bonds. If interest rates and inflation continue to rise, there is a greater likelihood that the Federal Reserve will raise its key interest rate at a faster pace this year. Rising interest rates are important for a few reasons. First, higher yields on “risk-free” bonds make stock markets look more expensive and bonds more attractive based on commonly used measures such as the price to earnings ratio (P/E) (see below). The rise in stock prices through January, coupled with the recent rise in interest rates made stocks look excessively expensive and decreased the demand for equities.

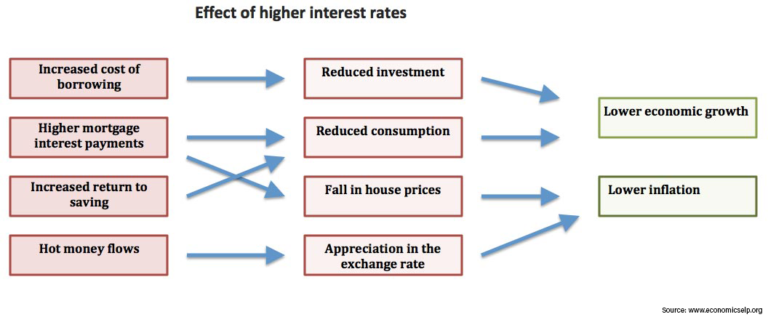

Second, rising interest rates can affect the activity of businesses and consumers by increasing interest expenses and making it more attractive to save rather than spend. These shifts in business and consumer activity eventually lead to lower economic growth and lower inflation.

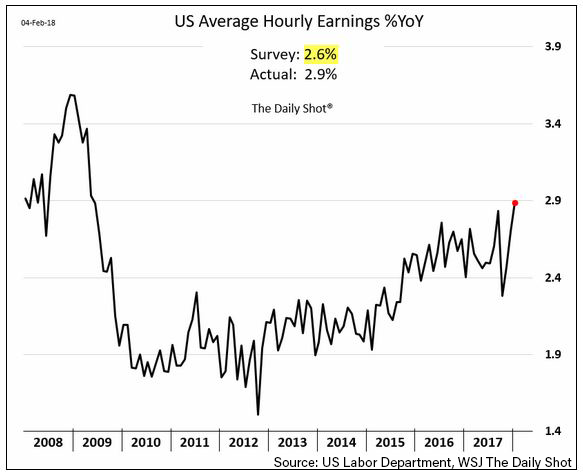

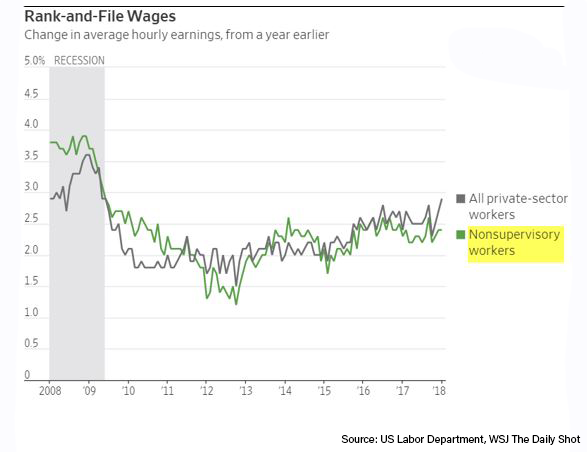

The February 2nd US jobs report increased the expectations that inflation and interest rates are going to rise faster than expected. Wage growth rose 2.9% year over year which was the fastest rate since 2008. Rising wages and low unemployment tend to lead to higher inflation because businesses are able to raise prices without negatively affecting demand. After digesting the news over the weekend, interest rates spiked on Monday and stocks continued to selloff. Volatility rose to the highest levels seen in years and reports of collapsing inverse volatility funds fueled additional selling.

Keeping Things in Perspective

While the recent selloff might feel like the beginning of a bad year for the stock market we see this as a normal and healthy correction and expect the markets to recover. Even though it might feel like it, the current bull market has not been correction proof. This is the fifth correction since 2009 and we have quite a ways to fall before it becomes one of the worst. The S&P 500 fell 19.4% in 2011 and was down 16% in 2010 during the start of the Greek debt crisis.

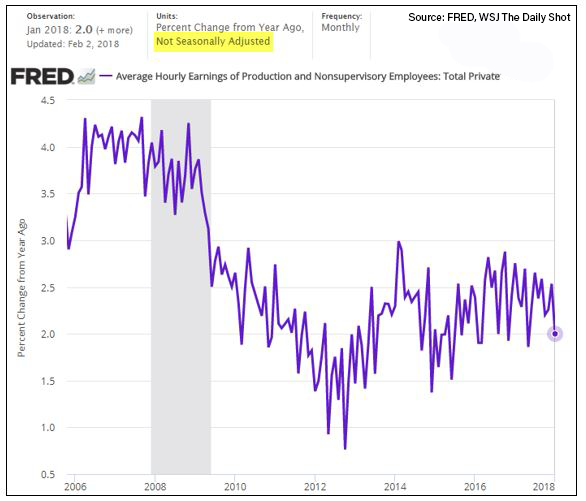

Digging into the underlying data we believe that the economy is heading in the right direction and will continue to support stock market growth over the medium to long-term. Looking back at the February 2nd jobs report the numbers may have been misleading. The wage increase was mostly due to growth among management and skilled employees. The bulk of the workforce (production and nonsupervisory employees) had much lower wage growth.

Additionally, monthly data is much more volatile than long-term data and seasonal adjustments may skew some results over the short term. Looking at non-seasonally adjusted wage growth it seems even more apparent that although wages are rising, they are not breaking out to excessive levels. Slower wage inflation does not mean that overall inflation will not rise, but a more stable rate of appreciation will help keep the economy on track without overheating.

Where are we Headed?

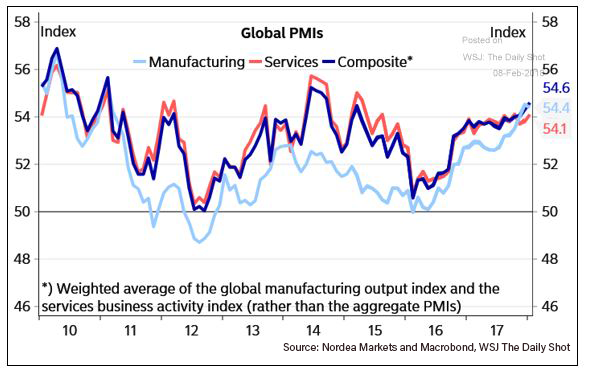

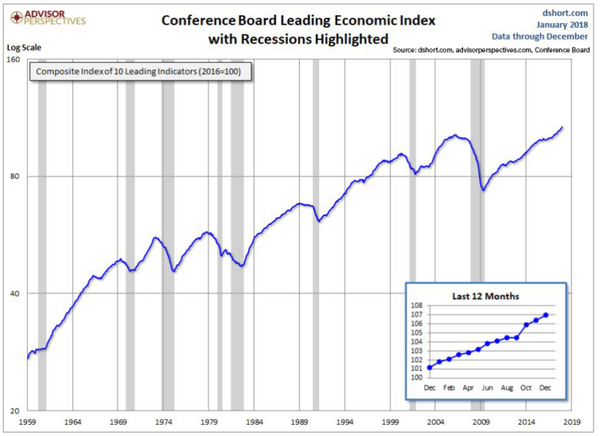

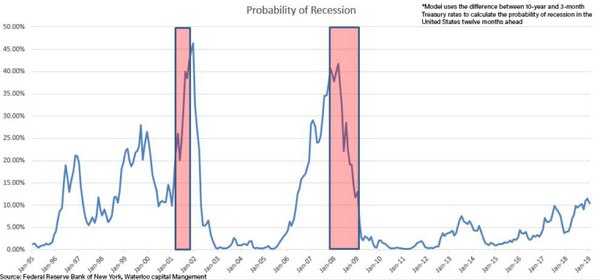

On the economic front, underlying data is still strong. PMI’s for both manufacturing and non-manufacturing industries are in expansionary territory, consumer confidence is still high, leading economic indicators are rising, and recession indicators are still low.

Going back to the equity markets, the P/E ratio of the S&P 500 has begun to fall because of positive Q1 earnings results and the recent selloff. The forward P/E of 16.35 as of today’s close is the lowest level since 2016. As valuation measures become more attractive we expect demand for stocks to recover and stabilize the markets. For now, we are looking at this pullback as a healthy indicator that we are in the later stages of a market cycle and that volatility is returning to the markets. Overall, our long-term outlook on global equities remains positive. Barring any significant changes in our models, we expect to use this pullback as a potential opportunity to deploy capital into our more tactical positions.