Global equity markets carried over positive momentum from Q4 into the new year, as investors continued to buy into the vaccination and reopening narrative. By the end of the quarter, over 17 million COVID vaccines were being administered per day. The rapid rollout increased optimism that the world would be returning to normal in the back half of 2021, which in turn boosted optimism for risk assets. Additional support for equities came from central banks remaining accommodative, and stimulus measures in both the US and Europe remaining on track. The biggest story for the markets overall was the steep incline in interest rates in developed economies. The US 10 Year Government Bond rate rose 25% over the first five trading days of 2021 and continued a steady climb through the end of the quarter. The move was a windfall for value-oriented equities which tend to perform well in a rising rate environment. Alternatively, rising rates created significant headwinds for bonds and long-duration assets, such as high P/E and high growth stocks, which lagged broad markets during the quarter. Overall, the MSCI ACWI Index climbed 4.2% and the Barclays Global Agg Bond Index fell -4.5%.

Q1 2021 Market Commentary

Domestic Equities

Equities performed well at the index level, but underlying rotations within the broader market led to wide performance dispersion at the sector and company level. Volatility picked up early, fueled by a swath of short squeezes which led to outperformance for some of the stock market’s fundamentally weakest companies. As the dust settled, positive news on the vaccine front continued to flow in which helped stocks more levered to the economic cycle outperform. Small caps advanced 12.7%, while at the sector level Energy (+30.6%), Financials (+15.9%), and Industrials (+11.3%) outperformed. As markets continued to price in a stronger recovery, fears arose that this strength would alter the trajectory of the current easy monetary policy. Treasury yields surged and growth stocks fell sharply as the velocity of the move in interest rates forced a market repricing. Rising interest rates can lead to higher borrowing costs and affect how investors value stocks by lowering the equity risk premium. The Federal Reserve tried to calm fears by reiterating its ultra-dovish stance and low interest rate policy until 2023 while continuing to push for fiscal stimulus from Washington. Their efforts kept short-term rates low for the quarter and their optimism for the economic recovery helped fuel investor demand for re-opening sectors.

On the economic front, the US’s robust vaccine rollout helped economic data rapidly improve. ISM’s manufacturing index jumped to its highest reading in 37 years while the service index hit its highest level on record. The final jobs report of the quarter showed development in the labor market as 916,000 jobs were added in March. Still, the unemployment rate remained far above from pre pandemic levels. Consumer spending, which makes up nearly 70% of economic activity sank 1% in February, however given the Biden administration’s $1.9 trillion fiscal stimulus bill in mid-March, spending is expected to accelerate. With the upwards trajectory of the US economy and massive fiscal stimulus measures, speculation of inflation continued. The latest CPI reading showed only a modest rise but is expected to jump in the coming months as price declines from the middle of the COVID-19 pandemic (March, April, May) wash out of the year-over-year calculations. Overall, the S&P 500 was up 6.2%, tech-heavy NASDAQ was up 2.9%, and DJIA up 8.3%.

Foreign Equities

The MSCI ACWI ex US lagged its US counterparts slightly finishing up 3.6%. As with the US, the United Kingdom’s vaccine rollouts were faster than expected, which helped in the relaxation of business restrictions. March economic data in the UK showed the fastest rate of economic expansion since the vaccine rollout. Given the economically sensitive makeup of UK’s equity markets, the indexes continued their rally from the end of last year ending the quarter up 4.9%. Specifically, banks outperformed given the increase in bond yields and prospects of a stronger economic outlook in the region. The eurozone economy was on shakier footing throughout the quarter, but overall market trends were similar to other developed markets with equity sectors more correlated to the recovery outperforming. Rising infections and a slower vaccine rollout in the eurozone cast doubt on a stronger recovery, especially in the service side of the economy. Bond yields in the eurozone began increasing in February, leading to fears that the rise could hamper the economic recovery. To counteract some of the move, the European Central Bank announced late in the quarter that they would increase bond purchases “significantly” over Q2 and potentially through the end of 2021. Overall, the MSCI EMU index rose 4.4%. Japanese equities rallied in the 7.0% in the first quarter on a brighter corporate earnings outlook and persistent weakness in the yen against the dollar. The country is still panning on the Tokyo Olympics to kick off in July, however without any overseas spectators.

The rollout of vaccines in emerging markets is still lagging their developed markets counterparts, however future optimism and growth progress helped the index record small gains for the quarter. Additionally, US dollar strength was a major headwind to the markets as a rising dollar increases funding and input costs for emerging markets. China, which has a large weight in the index, decreased 0.4% with the weakness of internet stocks causing a drag on performance. The potential for tighter central bank policies also weighed on Chinese equity markets. The central bank and government suggested less stimulus would be needed in the country after a sharp rebound in economic activity during the second half of 2020. Elsewhere in EM, Brazil finished deeply negative, down 11.1%, with the markets impacted by policy concerns and the government’s handling of the virus. Chile, which was the largest copper producer in 2020, was the top performer in the index aided by the metal’s strength. Overall, the MSCI EM index increased 1.9%.

Fixed Income

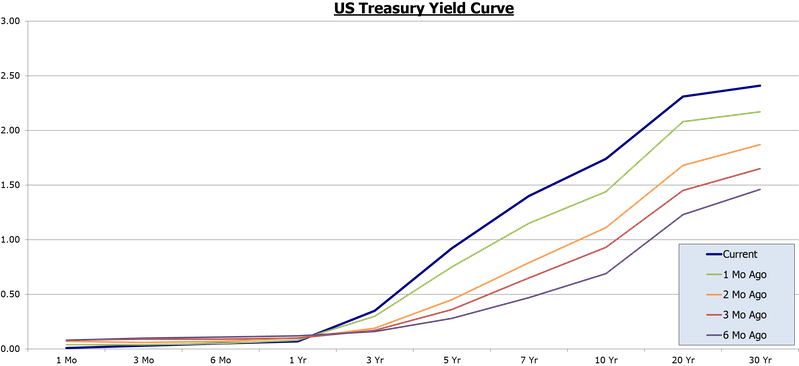

The surge in global bond yields led to price declines for much of the bond market. A steeper yield curve is a sign of confidence in the outlook for the global economy and rising inflation expectations. Inflation has been nearly impossible to come by in recent years, but with unprecedented amounts of fiscal stimulus injecting capital into the economy through direct payments to consumers and lending programs for businesses, the inflation outlook has been rising. Additionally, the long end of the yield curve is controlled more by the market than by central bank policies. Monetary policy focuses on short-term rates. This dynamic exacerbated yield curve steepening in many parts of the world as central banks kept a firm hold on the short-end of the curve while the long-end spiked. In the US, rising yields led to the second worst quarter of performance for US Treasuries since 1980, with the Barclays Agg US Treasury Index losing 4.3% for the quarter. Corporate bonds fared slightly better than government bonds. The improving outlook for the economy and signs of recoveries in corporate bottom lines kept demand for corporate paper high. The Markit Iboxx Corporate Bond Index lost 4% for the quarter. Spreads between riskier bonds and more secure bonds continued to decline. The difference in yield between high-yield bonds and investment-grade bonds fell to its lowest level in nearly a decade which helped high yield bonds outperform on a relative basis. The Barclays High Yield Corporate Bond Index returned 0.9% for the quarter. Overall, the Barclays US Agg Index fell 3.4% in Q1.

Rising yields and US dollar appreciation pulled down returns for global bonds as well. Ten-year government bond yields more than doubled in many countries. Shorter-duration bonds, which are less affected by rising rates outperformed while global bonds on the whole under performed. The Barclays Global Agg Ex US Index lost 5.3%. Emerging market bonds issued in local currencies fared poorly as a stronger US dollar and rising yields combined to drag down returns. The Barclays EM Local Currency Basket lost 6.3% for the quarter. EM bonds issued in US dollar terms performed better on a relative basis, but still saw a decline of 3.9% for the quarter. Global yield curves began to consolidate towards the end of the quarter, but higher inflation and growth expectations are likely to continue putting upward pressure on interest rates heading into the middle of the year.

Alternative Investments

Commodities were a bright spot for the markets in Q1. Global vaccination efforts and signs of stability in consumer and business activity spurred demand for many commodity products. Crude oil was the top performing commodity during the quarter. WTI Crude prices rose more than 22.5% as investors bet on demand outpacing a ramp up in production output as the world re-opens. Copper and other industrial metals also fared well. High demand came from the construction industry as well as a push from the Biden administration for a massive infrastructure spending plan to get underway this year. Strength in industrial and commercial construction activity in China were also a tailwind for metal prices. Copper prices rose 13.2% for the quarter and the Bloomberg Industrial Metals index rose 7.5%. Precious metals fell during the quarter. The sub-asset class tends to lose its luster when market demand is leaning more risk-on. Additionally, higher bond yields can make the relative value trade between bonds and precious metals less attractive. Gold spot prices fell 9.5% and silver prices fell more than 7%. Overall, the S&P GSCI Commodity Index rose 13.5% for the quarter which significantly outperformed broad equity markets. Publicly traded real estate also performed well during Q1. The overall REIT index was boosted by huge turnarounds in real estate sub-asset classes which had been the hardest hit by the pandemic as investors bet that consumers would be eager to get back to travelling and a brick-and-mortar shopping experience. Mall, retail, and hotel REITs outperformed and helped boost the return of the asset class in general. The DJ US Real Estate index returned 7.7% for the quarter. Hedge funds performed well during the quarter. Many strategies were able to capitalize on volatility across equity, fixed income, and currency markets. Wide swings in stock market prices led to outperformance by equity hedged strategies which were able to generate strong returns on long and short positions as market leadership rotated throughout the quarter. The HFRI Equity Hedge index returned 7.4% for the quarter. All major strategies posted positive returns for the quarter with equity-based strategies generating the best absolute performance and credit strategies generating the best relative performance versus their respective indices. Event-Driven strategies led equity strategy gains with a return of 8.2%. The HFRI Credit index was nearly a mirror image of the bond market with a gain of 4.3% for the quarter. Overall, the HFRI Composite index returned 6%.