Global markets continued climbing higher as we saw another good quarter in Q2. Re-openings and vaccine rollouts continued to fuel growth and positive sentiment for both the economy and the markets. Leading indicators hit multi-year highs across many countries and strong GDP growth projections helped consumer confidence reach levels not seen since before the pandemic. . The optimistic outlook led to positive results for risk-on assets as shown by the MSCI ACWI’s rise of 6.9%. Long duration assets such as bonds and growth equities saw a bounce back as the relentless climb in interest rates began to slow and reverse in some parts of the world. The Barclays Global Agg Bond Index rose 1.3%.

Q2 2021 Market Commentary

Despite the overall success, towards the end of Q2 we began to see a shift in the outlook for the second half of the year. The new Delta variant of COVID caused some concern overseas, and many countries saw broad market growth slow in June. Although it seems we are nearing the finish line, the Delta variant and the market consequences are a hurdle to keep an eye on globally and domestically moving into Q3 as it affects more and more countries.

Domestic Equities

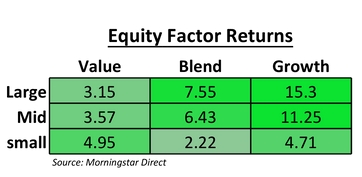

Domestic equities experienced another quarter of strong growth as COVID cases dwindled due to a broad increase in vaccination rates. The VIX, a measure of overall market volatility, fell to its lowest level since the pandemic, further fueling demand for equities. After seeing value stocks make a strong comeback during Q1, it was growth equities turn to lead the markets higher.

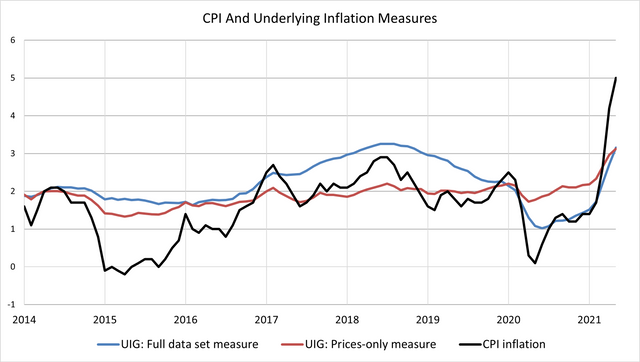

Hotter inflation data received considerable attention and injected bouts of volatility into markets. . The 0.6% increase in the CPI in May was higher than anticipated and brought the year-over-year increase to 5%, the highest in 13 years. However, the Fed insisted the rise is “transitory” as pandemic related bottlenecks and supply constraints created a perfect storm for rapidly rising prices, which they believe should unwind over the coming months. Additionally, the large Y/Y increase can be attributed to base effects coming from the extremely low readings during the pandemic a year ago. In a sign that the Fed is remaining cautious about inflation, members sped up their timeline for increasing interest rates, now seeing two hikes by 2023. Though a more hawkish tone on paper, the Fed’s comments outweighed the projections in the minds of investors. Chairman Jerome Powell indicated the path forward for the economy may still be uncertain due to the difficulty in deciphering data from the pandemic lows. The Fed has held interest rates near zero and purchased $120B worth of treasury or mortgage securities each month since the pandemic to support markets. The central bank continues to say that it expects to hold steady on this game plan until they are confident that inflation will stay above its 2% target and, more importantly, that the currently delicate labor market has healed. The potential for the Fed to remain involved in the market pulled interest rates lower which created headwinds for value names and supported growth sectors.

At a sector level, technology (11.5%) rebounded after a lackluster first quarter, energy (11.0%) continued its rise along with oil prices, and Real Estate (13.0%) ended as the best performer. Improving demand and a lack of supply in many real estate industries led to higher growth expectations for the sector going forward. While these sectors shined, Consumer Staples (3.3%), Industrials (4.4%), Materials (4.9%), and Utilities (-0.4%) saw slower growth and underperformed on a relative basis. Overall, the S&P 500 rose 8.6%, the NASDAQ saw a much better second quarter with the help of tech, rising 9.6% while the more industrial focused DJIA saw a more modest 4.6% gain.

Foreign Equities

Foreign equities, illustrated by the MSCI ACWI ex US Index, finished slightly behind their US counterparts rising 5.6%. Early strength during the quarter slowed in June as the index was down -0.6% during the month due to increasing concerns over the Delta variant of COVID. Cases rose in many countries and local economies were once again negatively impacted. There were lockdowns in Australia, India struggled with virus containment, and the UK delayed reopening plans despite high vaccination numbers. Despite the potential concern, there has not been significant crashes or even corrections in the market. The muted reaction potentially showed investor expectations that central banks and governments would be prepared to step in with new liquidity measures if the situation deteriorated further.

Eurozone equities rose in line with global equities. As with the US, the predominant activity in the market was a rotation towards growth. Defensive sectors including consumer staples and real estate also outperformed. While these sectors are historically defensive, they can also serve as inflation hedges given company’s ability to pass through more costs to consumers. Like the US, economic data pointed to further strength with PMIs rising to their highest levels since 2006. The markets were also helped by the ECB remaining extremely accommodative and leaning towards keeping policy measures in place for the foreseeable future. The MSCI EMU Index returned 7.1%. The UK lagged its neighboring region as COVID remained top of mind and the spread of the Delta variant delayed full reopening plans. Energy and other cyclical sectors led the way until June when the market shifted to a more defensive posture and the overall index declined. For the quarter, the MSCI UK All Cap Index rose 5.8%.

Emerging Markets altogether saw a positive quarter despite the lack of vaccines in many of these countries. Specifically, Brazil significantly outperformed rising 22.9% which offset double-digit losses in Q1. The rise was primarily due to higher demand for agriculture and industrial metal commodities. Russia also rode the commodity wave with gains of 14.0%. China posted disappointing returns at 2.3%. The country has been showing signs of slower growth as the sharp rebound from COVID has faded. Additionally, the markets reacted negatively to a more hands on approach from the government in both business and equity investing. India outperformed the overall EM index despite significant COVID headwinds returning 6.9% for the quarter. The gains were a sign of confidence in the ongoing recovery in southern Asia despite COVID headwinds. Many EM regions also benefitted from positive developments in currency markets. Emerging Market currencies had the best Q2 in 7 years as most firmed against the dollar due to inflation expectations. Overall, the MSCI EM Index was up 5.12% on the quarter.

Fixed Income

Demand for fixed income remained elevated as investors searched for yield and inflation hedges. The demand for higher yield led to outperformance by emerging market debt, US corporate debt, and both European and US high yield. In the US, yields declined with the 10-year Treasury falling to 1.47% from 1.74%. The decline came as investors contemplated whether surging inflation would be sticky or transitory. The transitory camp proved to be the most popular during the quarter with backing from Washington and the Federal Reserve. The yield curve went through a period of flattening after the Fed’s June meeting in which policy makers shifted to a more hawkish tone and moved up their projections for a rate hike. The short end of the curve rose while the long end fell. The flattening long end indicated fears of a Fed policy mistake which has been an ingredient in significant market drawdowns throughout history. Moderating US economic data was also a factor pulling rates lower. The economy still showed signs of a growth trajectory, but expectations of a plateau or second half slow down led to higher demand for bonds. The Barclays US Agg Bond Index climbed 1.7%. Inflation linked bonds, TIPs, also performed well during the quarter as investors continued to digest the Fed’s openness to higher than target inflation. The US 10-year breakeven inflation rate rose nearly 9% over the quarter. The Barclays US TIPS Index returned 3.3%. Corporate bonds performed well in Q2 with the Markit iBoxx Corporate Bond Index returning 3.2%. Demand for yield led to lower rates for both investment grade and high yield credits. Higher prices were driven by improving company fundamentals, high demand for new issues, and lower than expected default rates as the economy continued re-opening.

Foreign bonds underperformed the US as rates rose slightly or remained steady. The shift higher in yields was similar to the decline in bond demand for the US during Q1 which showed how Europe is following a COVID recovery pattern seen in the US and China. Overall, the rest of the world made up for the poor showing of European bonds. The Barclays Global Agg Ex US Index returned 0.9%. Emerging market bonds also performed well expounding on the theme of demand for higher yield, and therefore higher risk, fixed income. The move was also bolstered by positive moves in many EM currencies. The Barclays EM Local Issue Index rose 6.9% and the Barclays EM USD Agg Index rose 3%.

Alternatives

Commodities continued their 2021 charge with the S&P GSCI Index returning 15.7%. The rise was primarily due to higher oil prices. WTI and Brent spot prices both rose to levels not seen since 2018, climbing 24.4% and 18.2% respectively. Agriculture was another bright spot for commodity indexes. Poor crop outputs paired with rising demand led to a return of 17.5% for the S&P GSCI Agriculture Index. Industrial metals also performed well with returns of 9.4%. Demand for industrial commodities rose as many countries continued to push for infrastructure reforms and overall building activity improved. Precious metals generated positive returns but underperformed the broader commodity complex. Gold was the laggard with returns of 3.3% while silver returned 6.8% and palladium 5.9%. Precious metals tend to underperform during risk-on and higher interest rate environments. Real estate market remained hot as investors allocated to higher yielding assets. Additionally, real estate tends to benefit from an inflationary environment which likely increased demand for the asset class. Hotels were the only industry with negative returns for the quarter. Self-storage and homebuilders were the top real estate industries with returns of 23.6% and 15.8% respectively. Overall, the DJ US Real Estate Index returned 11.7% for the quarter. Hedge funds generated consistent returns across the board, outperforming bonds, but underperforming traditional equity markets. Equity hedged strategies were the top performing with returns of 5.4% for the quarter. These strategies tend to perform well during market rotations which have occurred frequently over the first half of 2021. Macro and event driven strategies also performed well as global currency and interest rate markets shifted back to more normal operations and M&A activity remained elevated. Overall, the HFRI Fund Weighted Composite Index returned 4% for the quarter.