Following the worst week of 2024, equities staged a small rebound on Monday, while bonds experienced a decline.

This Week on Wall Street - Week of April 15th

Market Commentary

Following the worst week of 2024, equities staged a small rebound on Monday, while bonds experienced a decline. Domestically, US retail sales surpassed forecasts, with revisions for the previous month also showing upward adjustments. Concerns surrounding the Iran-Israel conflict, which had gripped markets in recent days, have slightly eased.

Investors remain closely attuned to the Federal Reserve's commentary for insights into the trajectory of interest rates. To avoid a three-week losing streak, many market participants will need to look beyond recent suggestions that rate cuts might not materialize until the very end of 2024 due to persistent inflationary pressures.

In the realm of fixed income, yields are reaching their highest levels of 2024, propelled by stronger-than-anticipated economic indicators. The consumer sector continues to thrive, buoyed by the robust tailwind of accommodating financial conditions.

The S&P 500 sits near 5,150 off a few percentage points from all-time highs. In recent weeks, momentum has slowed and many traders are trying to determine if this is a healthy pullback or the start of a short-term downtrend. We are at the start of earnings season, where earnings are expected to grow for the third straight quarter year over year.

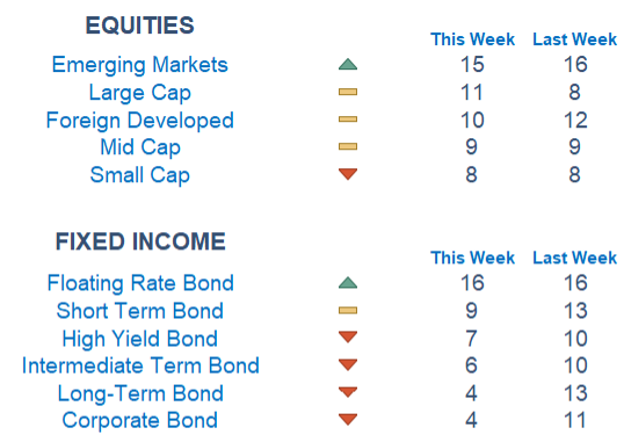

We are still seeing an elevated level of short-term rotation in the market. Large-cap growth has made a positive rate of change move. Small caps remain at the bottom of the pile relatively. Communications and Energy are on top sector-wise. Energy, notably, has a negative rate of change decrease. Real Estate and Utilities, interest rate-sensitive sectors, sit at the bottom.

Economic Releases This Week

Monday: Dallas Fed President Logan Speaks in Tokyo, Empire State Manufacturing Survey, US Retail Sales, Home Builder Confidence Index, SF Fed President Daly Speaks

Tuesday: Housing Starts, Building Permits, Industrial Production, Fed Chair Powell Speaks

Wednesday: Fed Beige Book, Cleveland Fed President Mester Speaks

Thursday: Initial Jobless Claims, Philadelphia Fed Manufacturing Survey, New York Fed President Williams Speaks, Existing Home Sales, US Leading Economic Indicators, Atlanta Fed President Bostic Speaks

Friday: Chicago Fed President Goolsbee Speaks

Stories to Start the Week

Late Saturday, Iran launched more than 300 drones and missiles at Israel, marking the first time Tehran directly attacked its adversary from its own territory.

One of the tallest towers in St. Louis that sold for $205 million in 2006 has changed hands for $3.6 million - the latest sign of lower demand in the commercial real estate market.

Caitlin Clark and Angel Reese headline one of the most anticipated WNBA drafts in recent years. Clark is expected to go first to the Indiana Fever tonight.

For the second time in three years, Scottie Scheffler has won the Masters.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.