We are seeing little changes in our model readings from last week as mid and small-cap areas lag behind large caps.

This Week on Wall Street - Week of April 17th

Market Commentary

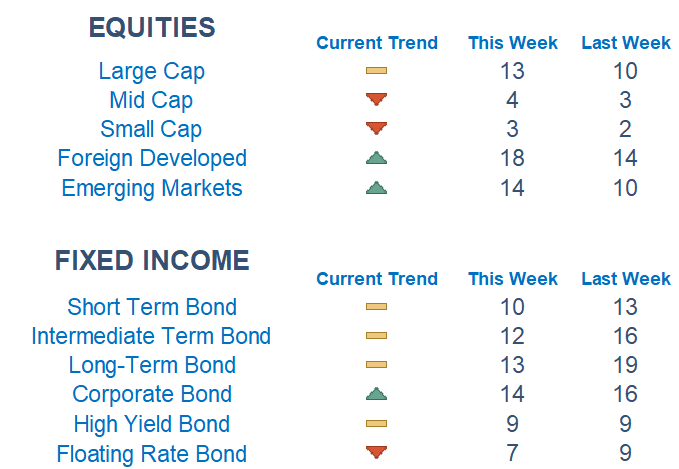

We are seeing little changes in our model readings from last week as mid and small-cap areas lag behind large caps. Foreign Developed is still showing relative strength while growth widened its gap over value.

The index is edging higher as it tries to break past its February highs. Traders are still trying to price in the bank turmoil fallout as they are now wagering that at least one more interest rate hike could be in store from the Fed. It is a lighter week on the economic front with a large amount of Fed speakers.

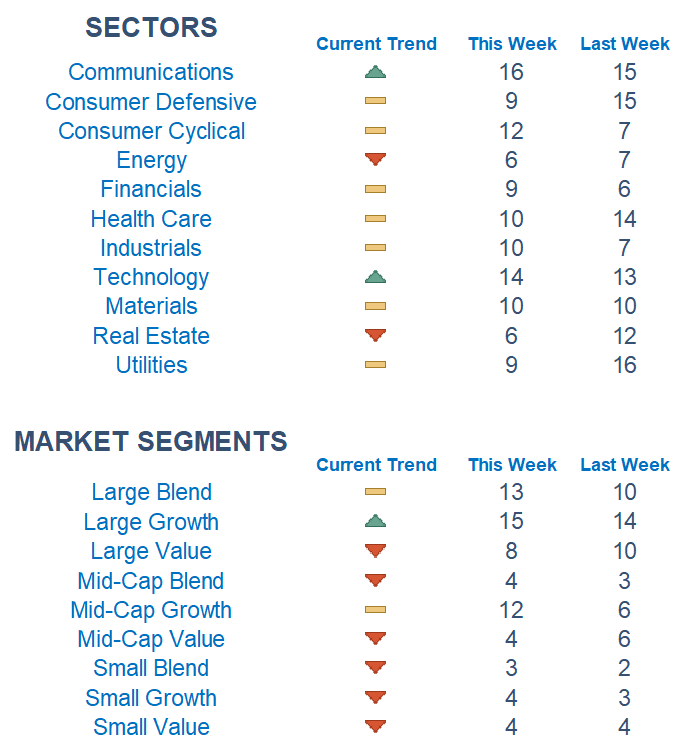

Among sectors, we are seeing strength out of Technology and Communications while Energy and Real Estate are at the bottom of the pile. Picking names with relative strength within sectors has remained the dominant and most effective strategy.

What is Newton?

r Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Economic Releases This Week

Monday: Empire State Manufacturing, Home Builder Confidence, Richmond Fed President Speaks

Tuesday: Housing Starts, Building Permits, Fed Gov. Bowman Speaks

Wednesday: Fed Beige Book, New York Fed President Williams Speaks

Thursday: Initial & Continuing Jobless Claims, Existing Home Sales, US Leading Economic Indicators, Cleveland Fed President Loretta Mester Speaks, Atlanta Fed President Bostic Speaks, Fed Gov. Waller Speaks

Friday: Flash Manufacturing and Services PMI, Fed Gov Cook Speaks

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.