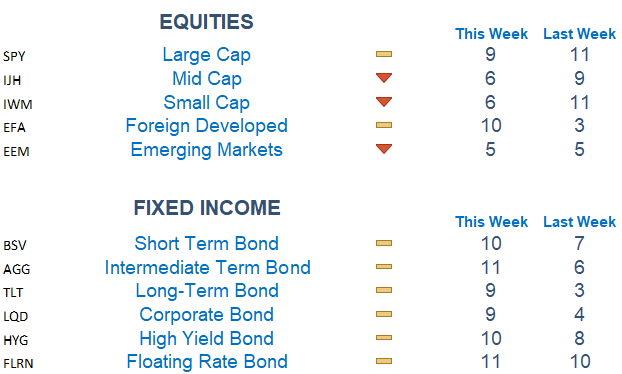

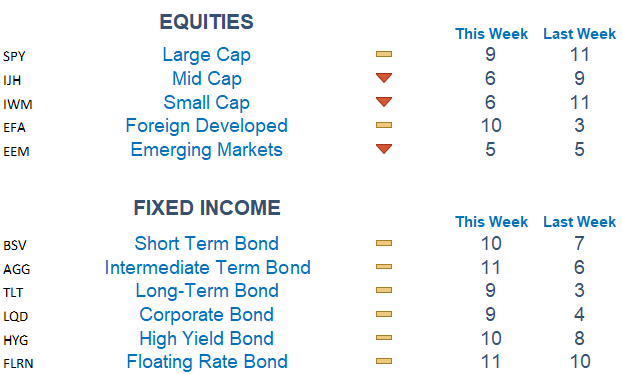

In aggregate, Newton scores reflect deterioration for broad equity markets with the exception of renewed relative strength observed in Forgein Developed markets. Recent turbulence in stocks has prompted investors to seek safety, allowing Fixed Income funds to improve over the last week. Beneath the surface, tactical reallocations from struggling areas of the market toward defensive positioning have instigated an improvement in Healthcare stocks.

This Week on Wall Street - Week of August 14th

Market Commentary

In aggregate, Newton scores reflect deterioration for broad equity markets with the exception of renewed relative strength observed in Forgein Developed markets. Recent turbulence in stocks has prompted investors to seek safety, allowing Fixed Income funds to improve over the last week. Beneath the surface, tactical reallocations from struggling areas of the market toward defensive positioning have instigated an improvement in Healthcare stocks.

Following the previous week's inflation figures that met expectations but revealed potential stickiness, investors are anticipating the FOMC meeting minutes for indications on how the Federal Reserve may navigate its policy path in the current inflation and economic landscape. Moreover, they could offer insights into the range of perspectives on the board, indicating whether the more hawkish or dovish viewpoints are gaining ground. Retail sales figures released on Tuesday will provide market participants with yet another data point to digest and adjust their expectations for the economy and, ultimately, the Fed.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Economic Releases This Week

Monday: None

Tuesday: Retail Sales, Business Inventories

Wednesday: Housing Starts, Capacity Utilization, FOMC Minutes

Thursday: Initial Jobless Claims, Philidelphia Fed Manufacturing Survey

Friday: None

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.