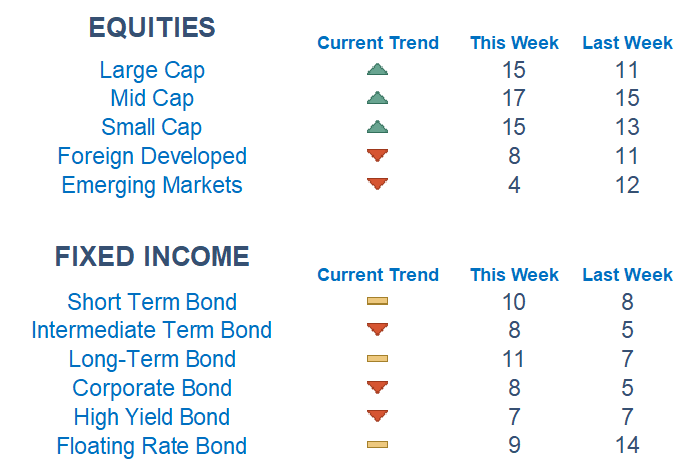

Our Newton models showed incremental strength in domestic risk-on markets while fixed-income areas remained weak.

This Week on Wall Street - Week of February 6th

Market Commentary

Our Newton models showed incremental strength in domestic risk-on markets while fixed-income areas remained weak. Foreign markets have slid over the past two weeks relative to their domestic counterparts. Small caps and value have a slight advantage over large caps and growth, respectively.

The lack of Fed hawkishness Wednesday fueled a violent rally on the index and sent yields lower. The push sent us on a path to testing the August 2022 highs before the rally was thwarted by extremely strong numbers out of the labor market on Friday. Good news for the economy was bad news for markets as a strong labor market might mean inflation will remain stickier and force the Fed to hold rates higher for longer.

Investors will be clued in to see if the key support area of 4,100 holds early in the week as bulls and bears fight over the path of restrictive policy and its effect on growth and inflation. It is a light week of economic news, but there is a large amount of Fed presidents speaking this week which could add volatility to markets as they discuss the outlook on policy.

We have now passed the midpoint in earnings season and according to FactSet the blended decline in Q4 earnings is -5.3%. If that number holds it will be the first time the index reported a YoY% decline since late 2020.

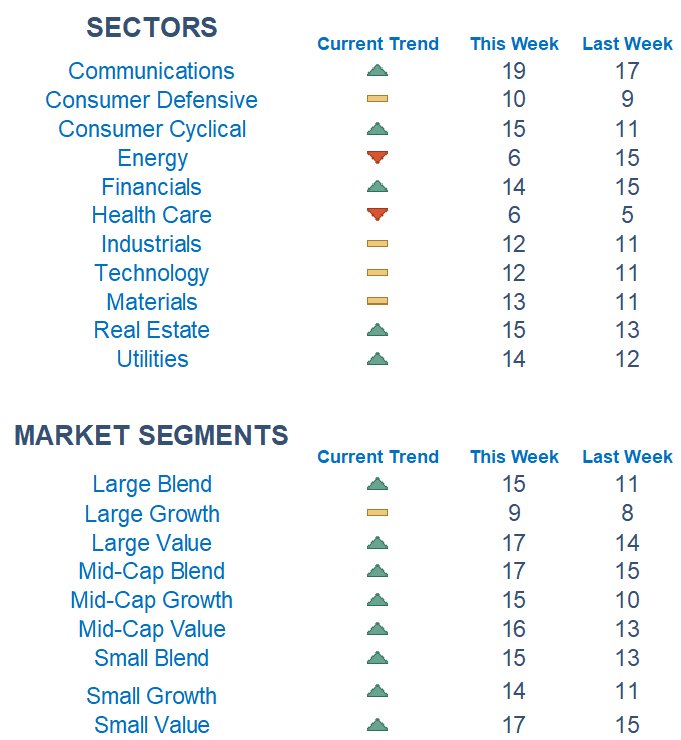

Among sectors, Communications were on top for another week and interest rate sectors like Real Estate and Utilities moved have begun grading out better. Energy and Health Care are currently grading out poorly. Picking names with relative strength within sectors has remained the dominant and most effective strategy.

What is Newton?

r Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Economic Releases This Week

Monday: None Scheduled

Tuesday: International Trade Deficit, Fed Chair Powell Speaks, Fed Vice Chair Barr Speaks, Consumer Credit

Wednesday: New York Fed President Williams Speaks, Atlanta Fed President Bostic Speaks, Minneapolis President Kashkari Speaks, Fed Gov Waller Speaks

Thursday: Initial & Continuing Jobless Claims

Friday: UMich Consumer Sentiment & Inflation Expectations, Philadelphia Fed President Harker Speaks

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.