Happy New Year! As we turn the page on the calendar, stocks' scorching rally is beginning to sputter as we kick off the trading week. The darlings of last year, such as the magnificent 7, are faltering the most.

This Week on Wall Street - Week of January 2nd

Market Commentary

Happy New Year! As we turn the page on the calendar, stocks' scorching rally is beginning to sputter as we kick off the trading week. The darlings of last year, such as the magnificent 7, are faltering the most.

Investors are gearing up for the earnings season, eagerly awaiting to see if this signals a mere hiccup or a longer-term halt in the bullish trend. During the week, we will get a closer look at the economy with two pivotal readings: ISM Services and ISM Manufacturing, which will shed light on the impact of rising rates on economic growth. Additionally, as we step into the first week of the month, the much-anticipated Friday jobs report will provide a clearer picture of the current state of the labor market.

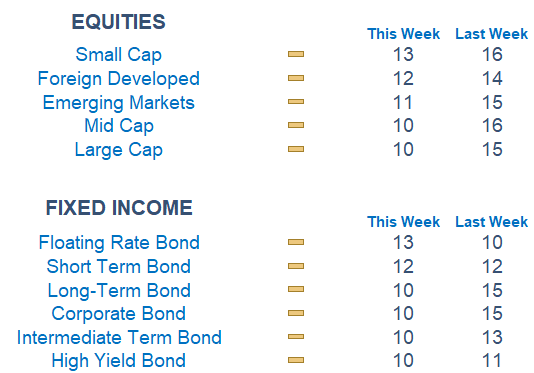

Newton scores have slid and are in decision territory as the move into smaller cap and value names solidifies itself. Communication and Health Care are leading while technology and Energy are faring the worst.

Economic Releases This Week

Monday: New Year's Holiday, Markets Closed

Tuesday: Construction Spending

Wednesday: Richmond Fed President Barkin Speaks, US Job Openings, ISM Manufacturing, December Fed Meeting Minutes

Thursday: ADP Employment, Initial Jobless Claims

Friday: ISM Services, US Employment Report

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.