Our Newton models have started to show recovery from low levels in risk on areas.

This Week on Wall Street - Week of January 30th

Market Commentary

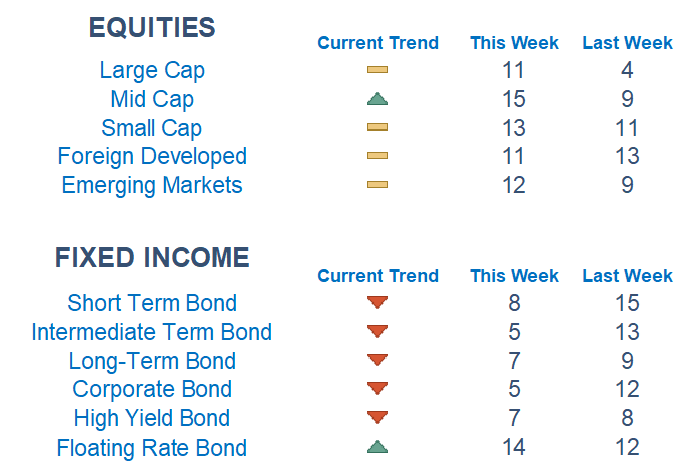

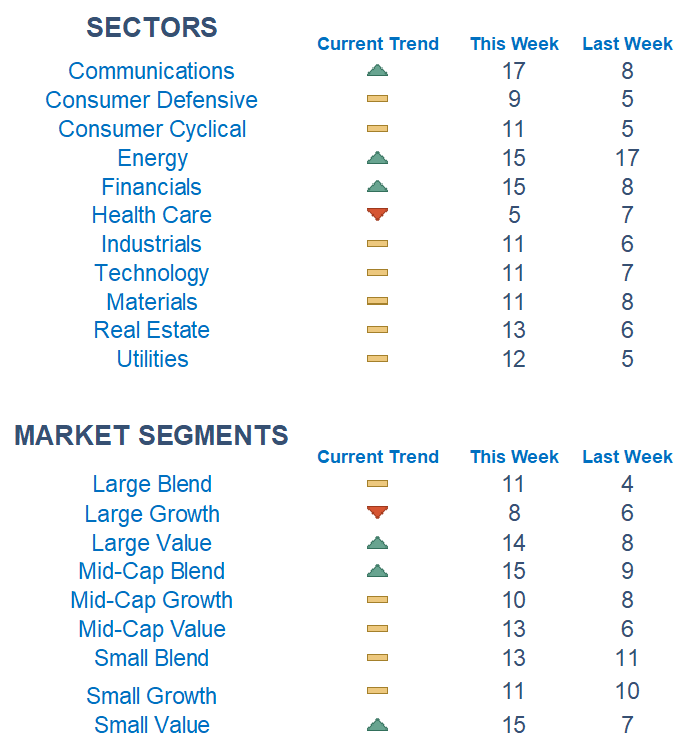

Our Newton models have started to show recovery from low levels in risk on areas. The models favor smaller-sized companies compared to large caps and value to growth. Fixed income areas pulled back as yields held support levels.

The index is now pushing towards 4,100 after it broke out of major resistance last week. Many investors will be eyeing the Fed and the jobs number this week for more clues on where policy and the economy are headed. Earnings season also presses on as we get reports from some of the mega-cap tech giants.

Among sectors, Communications, Energy, and Financials are graded out well while Health Care is graded out the worst. Picking names with relative strength within sectors has remained the dominant and most effective strategy.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Economic Releases This Week

Monday: None Scheduled

Tuesday: Employment Cost Index, S&P Case-Shiller Home Price Index, Consumer Confidence Index

Wednesday: ADP Employment Report, ISM Manufacturing Index, Job Openings, Fed Meeting & Jerome Powell Speaks

Thursday: Initial & Continuing Jobless Claims, Factory Orders

Friday: Jobs Report, ISM Services Index

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.