Our model readings have seen much rotation in the last few weeks. Currently, we are seeing a return to mega-cap growth names as mid and small-cap names take a pause.

This Week on Wall Street - Week of June 20th

Market Commentary

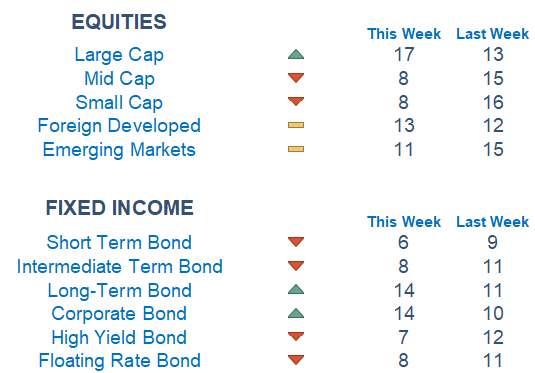

Our model readings have seen much rotation in the last few weeks. Currently, we are seeing a return to mega-cap growth names as mid and small-cap names take a pause. Interestingly, the long end of the yield curve is looking more constructive. Overseas, Foreign Developed and Emerging Markets have neutral readings.

The Fed, as expected, left interest rates unchanged as they wait to see how long and variable the effects of their 10 straight hikes will have on the economy. Investors are caught on a fine line lately between fear of missing out amid bullish technicals and concerning economic headwinds and valuations. There is light Fed Speak this week to give investors more clues on where the economy is headed.

Among sectors, we are seeing Discretionary, Communications, and Technology back on top. More economically sensitive sectors like Energy and Materials underperforming according to our model. Picking names with relative strength within most sectors has remained the dominant and most effective strategy.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Economic Releases This Week

Monday: None

Tuesday: Housing Starts, New York Fed President Speaks

Wednesday: Fed Chair Powell Testifies to House Panel

Thursday: Initial & Continuing Jobless Claims, Existing Home Sales, Fed Chair Powell Testifies to Senate Panel, US Leading Economic Indicators

Friday: Flash Services & Manufacturing PMIs

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.