Equity markets kicked off the week on a strong note, rebounding from previous weeks' sluggish performance, particularly within the mega-cap sector.

This Week on Wall Street - Week of March 18th

Market Commentary

Equity markets kicked off the week on a strong note, rebounding from previous weeks' sluggish performance, particularly within the mega-cap sector. Notably, Alphabet Inc. saw gains following reports of Apple's discussions to integrate Google's Gemini artificial intelligence engine into the iPhone.

Investor attention is keenly focused on the U.S. Federal Reserve's upcoming monetary policy announcement and economic forecasts, set for release on Wednesday. Investors do not expect a rate cut this week, but are anxious to see if the Fed maintains its projection of three interest rate cuts in 2024, amidst slower-than-expected inflation decline.

Despite concerns, stock markets have soared to new highs, reflecting investor confidence in corporate earnings surpassing worries about increasing interest rates. However, the uptick in long-term Treasury yields points to underlying market unease, with worry that the Federal Reserve could adjust its neutral rate estimate upwards. Such a move could signal a shift towards a "higher for longer" scenario, potentially affecting both bond and stock markets adversely.

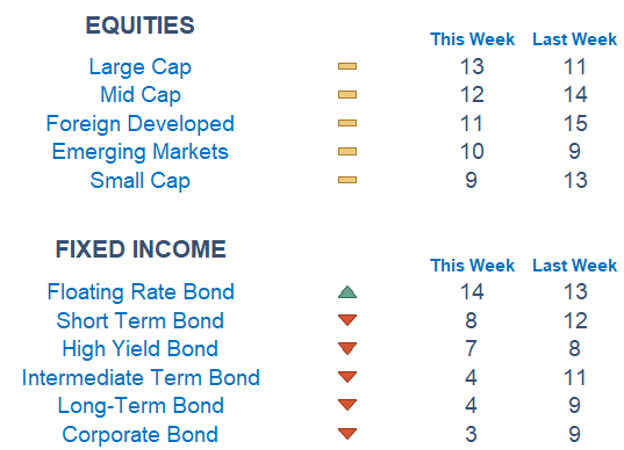

Large and Mid Cap stocks are rebounding from their recent slump, with the Energy sector emerging as this week's standout performer, according to Newton. Following Energy, the Materials and Healthcare sectors are also showing significant improvements. In Fixed Income, Floating Rate debt is showing a signs of strengthening, while Corporate Debt is lagging.

Stories to Start the Week

The global chocolate industry is facing a major crisis as demand is vastly outweighing cocoa supply.

Putin was declared winner of a race that was never in doubt.

On Thursday, Reddit will become the first social media platform since Pinterest in 2019 to go public.

Nvidia's CEO Jensen Huan will deliver the keynote address at their annual GTC conference.

Sgugeucgu Begusgum the inventor of the world's first commercially-available karaoke machine, has died at 100 years old.

Economic Releases This Week

Monday: Home Builder Confidence Index

Tuesday: Housing Starts, Building Permits

Wednesday: FOMC Interest Rate Decision, Fed Chair Powell Press Conference

Thursday: Initial Jobless Claims, Philadelphia Fed Manufacturing Survey, S&P Flash US Services and Manufacturing PMI, US Leading Economic Indicators, Existing Home Sales

Friday: Atlanta Fed President Bostic Speaks

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.