We are seeing improvement from very low levels in our model readings led again by the large caps.

This Week on Wall Street - Week of March 27th

Market Commentary

We are seeing improvement from very low levels in our model readings led again by the large caps. Uncertainty still looms over Wall Street as the impact of the banking crisis continues to play itself out. The bond market has been extremely volatile as 2-year yields have gone from over 5% to 3.8% in the matter of a month as investors fled to safety.

Last week the Fed kept its balancing act between battling inflation and supporting the banking system with liquidity by hiking an expected 25bps. Powell communicated that the central bank is close to the end of its rate-hiking cycle. The Fed's preferred inflation gauge (Core PCE) comes out Friday and will likely give the most amount of information for investors out of the data releases this week.

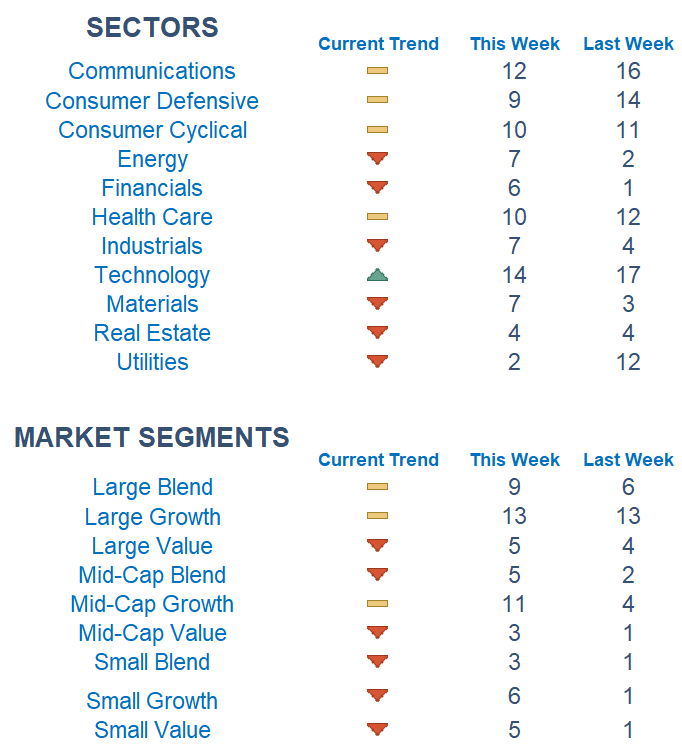

Although markets began the year with a risk on tone, the last month has seen more defensive positioning among market participants. Among sectors, we are seeing strength in Technology and Communications while interest rate-sensitive Utilities and Real Estate are grading out the weakest. Picking names with relative strength within sectors has remained the dominant and most effective strategy.

What is Newton?

r Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Economic Releases This Week

Monday: Fed Gov. Jefferson Speaks

Tuesday: S&P Case-Shiller Home Price Index, Consumer Confidence, Fed Gov. Barr testifies to Senate on Banks

Wednesday: Fed Gov. Barr testifies to Senate on Banks, Pending US Home Sales

Thursday: Initial & Continuing Jobless Claims, GDP (2nd Revision), Boston Fed President Collins Speaks

Friday: PCE Index, Consumer Sentiment, Fed Gov. Waller Speaks, Ney York Fed President Williams Speaks

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.