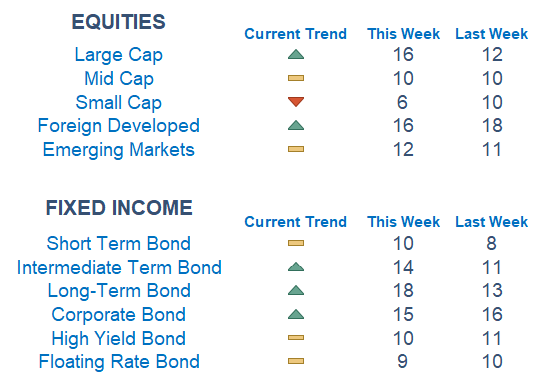

Our model readings slightly improved as the theme from last week remained; Large caps are holding strong against small caps while growth is beating value.

This Week on Wall Street - Week of May 1st

Market Commentary

Our model readings slightly improved as the theme from last week remained; Large caps are holding strong against small caps while growth is beating value.

It is a huge week on the economic data front as we get more readings on the economy, a Fed interest rate decision, and insight into the strength of the labor market. Investors will have all eyes on Wednesday's Fed meeting as the chance of a 25bp rate increase stands at 90%. Additionally, we got news early this morning that JPMorgan Chase agreed to acquire First Republic Bank in a government-led deal.

We are still in a choppy trading zone as traders look to 4,180 as strong resistance. Most of the mega caps reported last week, but we are only halfway through earnings season so expect continued volatility beneath the surface.

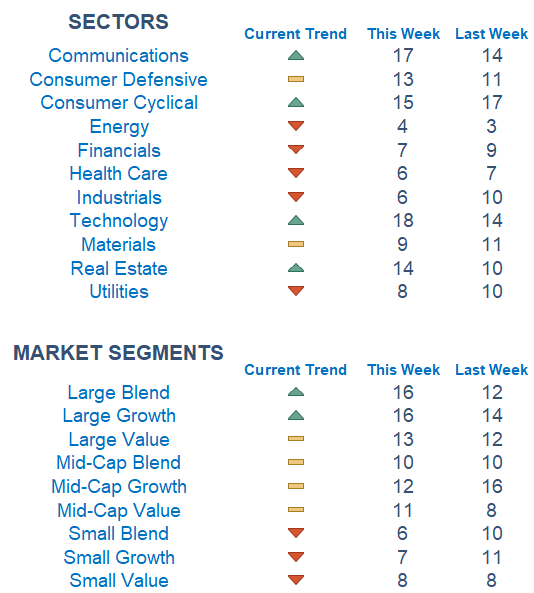

Among sectors, we are seeing strength out of Cyclicals, Technology, and Communications while Financials, Utilities, Energy, and Health Care are at the bottom of the pile. Picking names with relative strength within sectors has remained the dominant and most effective strategy.

What is Newton?

r Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Economic Releases This Week

Monday: ISM Manufacturing

Tuesday: US Job Openings

Wednesday: ADP Employment, ISM Services, Fed Decision

Thursday: US Productivity, US Trade Deficit, Initial & Continuing Jobless Claims

Friday: Jobs Report, Consumer Credit

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.