Equities entered the week steady as traders look ahead to tomorrow's earnings results from Nvidia, which has been a large part of the S&P 500's earnings.

This Week on Wall Street - Week of May 20th

Market Commentary

Equities entered the week steady as traders look ahead to tomorrow's earnings results from Nvidia, which has been a large part of the S&P 500's earnings. The stock has had a historical advance, supported by the boom in artificial intelligence. Investors are also keeping an eye on commodities as gold, copper, and silver continue their advances. It is leading many to pause for concern that inflation will keep easing and the Fed will initiate rate cuts in 2024.

After last week's advance, the S&P 500 is back near all-time highs. After the recent pullback, many traders are noting the potential double top formation on the index, and we will be watching to see if a strong report out of Nvidia can help the index break through resistance or take another pause. This resistance level, coupled with other medium-term uptrend factors, is crucial for sustaining momentum.

This week is light on economic data, however we will see a flood of Fed speak. We will be watching for inflections on language as Fed presidents have started to switch from rate cuts to being patient throughout the year. The key report will be on Wednesday with the Minutes of the Fed's May FOMC meeting.

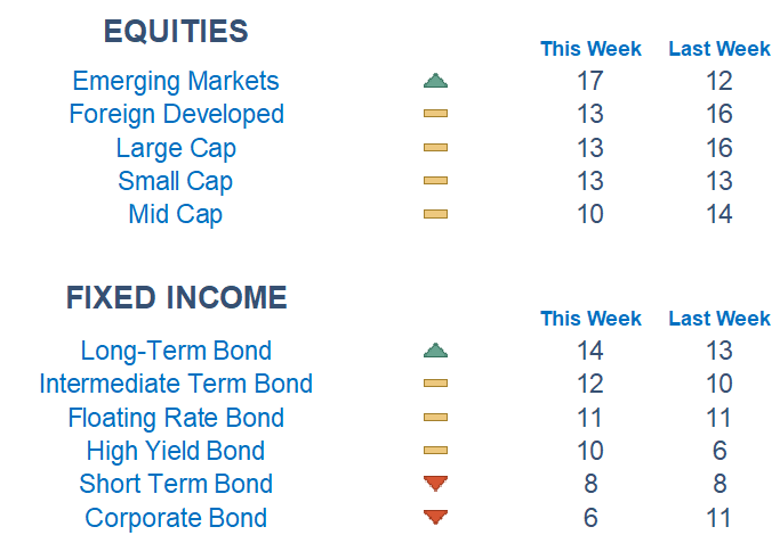

Our Newton models indicate relative strength in Emerging and Foreign Developed markets. Utilities continue to lead, showing robust performance over the past few weeks while Materials and Cyclicals lag.

Economic Releases This Week

Monday: Fed Vice Chair for Supervision Barr Speaks, Fed Vice Chair Jefferson Speaks

Tuesday: Fed Gov Waller Speaks, Cleveland Fed President Mester Speaks, Atlanta Fed President Bostic Speaks, Boston Fed President Collins Speaks

Wednesday: Existing Home Sales, Minutes of Fed's May FOMC Meeting

Thursday: Initial Jobless Claims, S&P Flash Manufacturing & Services PMI, New Home Sales

Friday: Durable Goods Orders, Consumer Sentiment

Stories to Start the Week

Iranian President Ebrahim Raisi was found dead, hours after his helicopter crashed in fog.

Red Lobster filed for Chapter 11 bankruptcy.

Elon Musk's Neuralink gets the FDA green light for a second patient.

Ivan Boesky, the infamous insider trader and who helped inspire the fictional Gordon Gekko character, died at 87.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.