The stock and bond markets started the new week on a positive note, displaying a calm demeanor. However, there's a significant split among Wall Street analysts regarding the Federal Reserve's potential policy direction next year. This debate is particularly timely, given the recent volatile movements in Treasury bonds. The upcoming week promises to shed more light on this matter, with the release of the critical Consumer Price Index (CPI) report and a substantial amount of commentary from Federal Reserve officials.

This Week on Wall Street - Week of November 13th

Market Commentary

There's a prevailing anticipation that U.S. inflation, although expected to have eased in October, will still exceed the Federal Reserve's 2% target. Forecasts suggest a modest month-over-month CPI increase of 0.1% and a year-over-year rise of 3.3%, a decrease from the previous figures of 0.4% and 3.7%, respectively. The recent downtrend in energy prices is likely to contribute to this anticipated decrease in inflationary pressures.

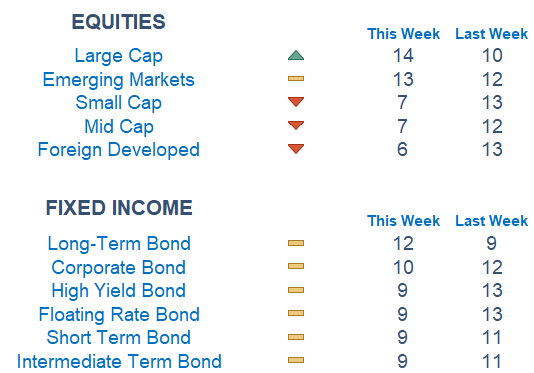

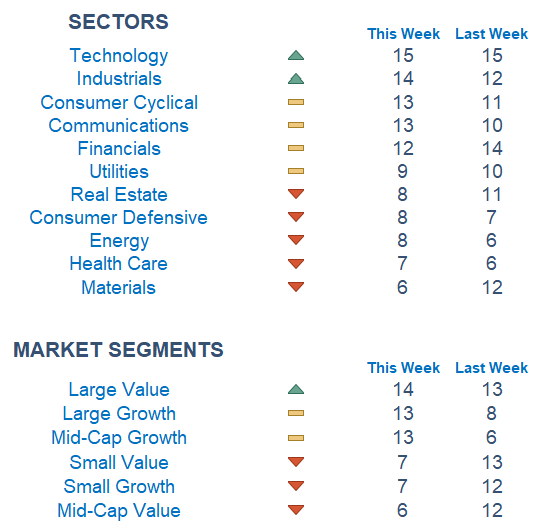

To note: Newton scores are now being sorted from largest to smallest based on their current score. Large caps stayed near last week's levels as smaller cap names retreated. In Fixed Income, the long bond is grading out the best relatively. Under the surface, Technology is on top for the second week in a row alongside Industrials. Materials and Real Estate are lagging the most.

Economic Releases This Week

Monday: Monthly US Federal Budget, Fed Governor Lisa Cook Speaks

Tuesday: New York Fed President John Williams Speaks, Fed Vice Chair Phillip Jefferson Speaks, NFIB Optimism Index, Consumer Price Index

Wednesday: Producer Price Index, Retail Sales, Empire State Manufacturing Survey, Business Inventories, Richmond Fed President Barkin Speaks

Thursday: Initial & Continuing Jobless Claims, Import Price Index, Philadelphia Fed Manufacturing Survey, Cleveland Fed President Mester Speaks, New York Fed President Williams, Fed Governor Waller Speaks, Home Builder Confidence Index, Fed Governor Lisa Cook Speaks

Friday: Housing Starts, Building Permits, Boston Fed President Collins Speaks, Chicago Fed President Goolsbee Speaks, SF Fed President

Stories to Start Your Week

Markets on Monday shrugged at a warning Friday from Moody’s Investor’s Service that it was lowering its rating outlook on Treasurys.

Exon Mobil aims to become a leading producer of lithium for electric vehicle batteries through a drilling operation the oil giant is launching in Arkansas.

Novo Nordisk’s Wegovy slashed the risk of serious cardiovascular complications in people with obesity and heart disease.

“The Marvels” generated an estimated $47 million domestically over its debut weekend, the lowest in franchise history.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.