Happy Thanksgiving week! As we enter this festive period, financial markets are showing optimism. The prevailing sentiment is that the Federal Reserve may be concluding its cycle of interest rate hikes, a development that has spurred a rally in both stocks and bonds. Many see inflation falling back to the Fed's 2% target without a material upswing in unemployment and odds stand at 28% of a cut at the March 2024 meeting. However, it's worth considering that this tapering in inflation might be attributed to a decrease in consumer demand.

This Week on Wall Street - Week of November 20th

Market Commentary

Happy Thanksgiving week! As we enter this festive period, financial markets are showing optimism. The prevailing sentiment is that the Federal Reserve may be concluding its cycle of interest rate hikes, a development that has spurred a rally in both stocks and bonds. Many see inflation falling back to the Fed's 2% target without a material upswing in unemployment and odds stand at 28% of a cut at the March 2024 meeting. However, it's worth considering that this tapering in inflation might be attributed to a decrease in consumer demand.

Turning our attention to the S&P 500 index, it has rebounded to near its August highs of around 4,500, a crucial resistance level. This resurgence witnessed over the past three weeks, has been driven by a decline in interest rates, leading to a broad-based rally. Particularly noteworthy has been the recovery in stocks that had previously seen the most significant declines this year – a trend dubbed as the "dash for trash." This trend will be closely monitored as we move into the new year, with market participants eager to see if these gains hold steady. A key event this week is Nvidia's earnings report. Given its significant weight of over 2% in the index, Nvidia's performance could disproportionately influence the S&P 500.

It is a slower news flow week given the holiday, yet many will be focused on the Fed Minutes. This data release will shed some light on the previous Fed meeting where Powell & Co. kept rates steady. Drilling deeper the minutes should have language that officials are seeing a cooling down in the labor market, justifying the pause.

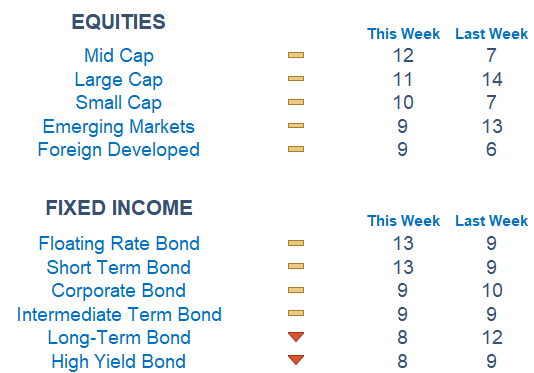

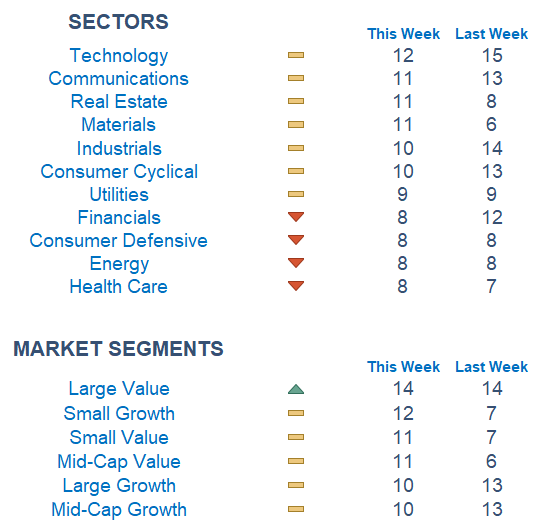

Newton scores remain at average levels, even after the push higher in indexes last week. Under the surface, Technology is on top for the third week in a row while Health Care, Energy, Consumer Defensives, and Financials lag.

Economic Releases This Week

Monday: US Leading Economic Indicators

Tuesday: Existing Home Sales, Minutes from the Fed's Late October Meeting

Wednesday: Initial Jobless Claims, Consumer Sentiment

Thursday: Thanksgiving Holiday (Markets Closed)

Friday: Flash Services and Manufacturing PMIs (Markets Close Early)

Stories to Start Your Week

OpenAI, the company behind ChatGPT, ousted its CEO Sam Altman late Friday. Throughout the weekend, a deal was nearly in place to return Altman to the throne before OpenAI brought on former Twitch CEO Emmett Shear.

Argentina's libertarian President-elect Javier Milei has won a closely fought election. Now comes the hard part: dealing with economic crises.

More Americans on Ozempic means smaller plates at Thanksgiving.

President Joe Biden turns 81 today, a milestone likely to draw attention to his status as the oldest person to ever occupy the Oval Office.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.