We hope everyone enjoyed their Thanksgiving! As we step into a new week, Wall Street is poised to wrap up November on a strong note, building on 4 consecutive weeks of gains in the stock market.

This Week on Wall Street - Week of November 27th

Market Commentary

We hope everyone enjoyed their Thanksgiving! As we step into a new week, Wall Street is poised to wrap up November on a strong note, building on 4 consecutive weeks of gains in the stock market.

Today, stocks are pulling back slightly after hitting overbought levels and the "fear gauge" index hiting its lowest level since 2020. Investors and traders alike are keenly watching key consumer spending figures post-Black Friday and parsing through a multitude of Fed speak. Later in the week, we get a read on the Fed's preferred inflation gauge, the Personal Consumption Expenditures (PCE) index. Economists are anticipating a decline to 3.1% YoY from 3.4% last month. This indicator is important as it influences future monetary policy decisions.

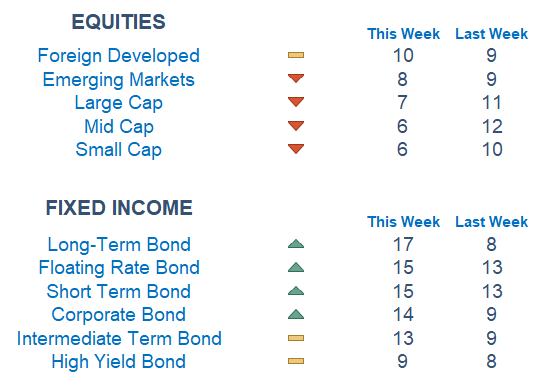

Newton scores backed off from average levels last week as foreign markets show relative strength. Fixed Income is showing strength with the long bond taking the lead on the duration front. Beneath the surface Utilities are the only sector graded buy while cyclicals lag.

Economic Releases This Week

Monday: New Home Sales

Tuesday: S&P Case Shiller Home Price Index, Consumer Confidence, Fed Gov. Waller Speaks, Chicago Fed President Golsbee Speaks, Fed Governor Bowman Speaks, Fed Governor Barr Speaks

Wednesday: GDP (First Revision), Cleveland Fed President Mester Speaks, Fed Beige Book

Thursday: Initial Jobless Claims, Personal Income, Personal Spending, PCE Index, New York Fed President John Williams Speaks, Pending Home Sales

Friday: Fed Governor Barr Speaks, ISM Manufacturing, Chicago Fed President Goolsbee Speaks, Fed Chair Powell Speaks

Stories to Start Your Week

Black Friday e-commerce spending popped 7.5% from a year earlier, reaching a record $9.8 billion in the US.

On this day in 1895, Alfred Nobel signed his last will leaving the equivalent of $265 million toward establishing the Nobel Prizes.

President Biden will convene today on the first meeting of his supply chain resilience council. The event will be used to announce 30 actions to improve access to medicine and other needed programs tied to the production and shipment of goods.

17 hostages held by Hamas in Gaza were released Sunday. Israel released 39 Palestinian prisoners in return. The first limited pause in fighting formally began on Friday.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.