We enter the week coming off a large bullish reversal in equities on Friday. Yet, over the weekend, Hamas' surprise attack on Israel increased anxiety among traders causing risk on assets to stumble out of the gates. Defense and oil names surged, while safer assets like gold and bonds also rose.

This Week on Wall Street - Week of October 9th

Market Commentary

We enter the week coming off a large bullish reversal in equities on Friday. Yet, over the weekend, Hamas' surprise attack on Israel increased anxiety among traders causing risk on assets to stumble out of the gates. Defense and oil names surged, while safer assets like gold and bonds also rose.

At the index level, even though we saw bullish action on the last day of the week, we will be looking for more follow-through to see if it was an oversold bounce or a resumption of the uptrend we've seen over the last 10 months.

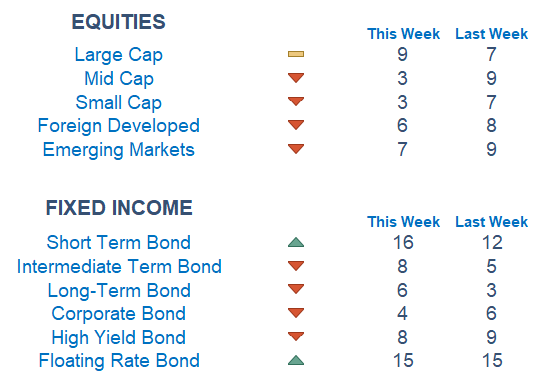

Newton scores are weak across styles with growth edging out value for the first time in a few weeks. Large caps look better relatively than small caps. Communications are leading the market while Utilities are lagging.

On the economic front: It is a quiet week until Wednesday and Thursday. First, we get the FOMC minutes for increased insight on the discussion from their latest meeting. Then, we get another read on inflation. Estimates call for a slight decrease in the headline number from 3.7% to 3.6%.

Economic Releases This Week

Monday: Dallas Fed President Logan Speaks, Fed Gov. Jefferson Speaks

Tuesday: NFIB Optimism Index, Wholesale Inventories

Wednesday: Producer Price Index, Core PPI, FOMC Minutes

Thursday: Initial & Continuing Jobless Claims, Consumer Price Index

Friday: Import Price Index

Stories to Start Your Week

Israel is at war with Hamas after the group launched an attack on Israeli territory from Gaza on Saturday morning.

Genetic profiling service 23andMe has commenced an investigation after private user data was scraped off its website.

The largest Powerball jackpot of the year grew again after no one matched all the numbers on Saturday. The jackpot for tonight's drawing is an estimated $1.55 billion.

Many NFL players are notorious for leading lavish lifestyles. San Francisco 49ers starting QB Brock Purdy is not one of them as splits rent with one of his teammates and drives a Toyota Sequoia SUV.

What is Newton?

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score. Trend & level both matter.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.